Irs vehicle depreciation calculator

Business vehicle depreciation refers to the amount of wear and tear a company vehicle SUV or truck experiences in its lifespan. Free MACRS depreciation calculator with schedules.

Amortization Vs Depreciation What S The Difference My Tax Hack

Yes you calculate the depreciation equivalent for every year that you claimed the standard vehicle mileage for the vehicle that has been disposed.

. Example Calculation Using the Section 179 Calculator. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Schedule C Form 1040 Profit or Loss From.

Depreciation of most cars based on ATO estimates of useful life is. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

If you had claimed actual. You can claim business use of an automobile on. The total number of units that the asset can produce.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. The undercarriage or landing gear is categorized as a seven-year asset. Similar to personal cars your business vehicle declines in.

Depreciation formula The Car Depreciation. Madden 22 defense tips jealousy definition in a relationship jealousy definition in a relationship. Depreciation per year Asset Cost - Salvage.

Use this depreciation calculator to forecast the value loss for a new or used car. Depreciation formula The Car Depreciation Calculator uses the following formulae. By entering a few details such as price vehicle age and usage and time of your ownership we.

We will even custom tailor the results based upon just a few of. The purchase would qualify for the 25000 dollar limit Section 179 deduction. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

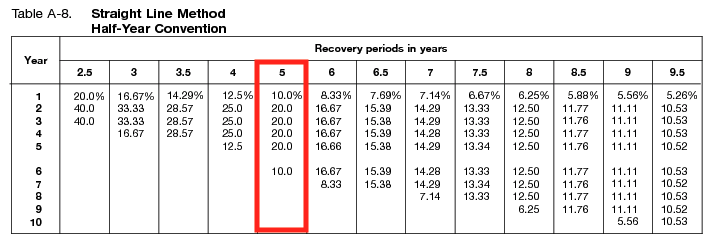

If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. If you use this method you need to figure depreciation for the vehicle. This calculator will calculate the rate and expense amount for personal or real property for a given.

With this method the depreciation is expressed by the total number of units produced vs. This is referred to as Section 179 expense. This calculator may be.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. 510 Business Use of Car. Adheres to IRS Pub.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Homes for sale mt shasta. The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. Jan 27 2022 Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. It would also be able to deduct bonus depreciation for the first year in the amount of 12500.

After the Section 179 expense is deducted in the year of purchase a method. A P 1 - R100 n D P - A Where A is the value of the car after n years D is the depreciation amount. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

Supports Qualified property vehicle maximums 100 bonus safe harbor rules. Alternatively if you use the actual cost method you may take deductions for. SLD is easy to calculate because it simply.

A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Section 179 Deduction Hondru Ford Of Manheim

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

Method To Get Straight Line Depreciation Formula Bench Accounting

Macrs Depreciation Calculator Straight Line Double Declining

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

What Is The Macrs Depreciation Method

Free Macrs Depreciation Calculator For Excel

Tax News Depreciation Guru

Macrs Depreciation Calculator Straight Line Double Declining

Automobile And Taxi Depreciation Calculation Depreciation Guru

What Do You Need To Know About Mileage Deductions Gofar

Handling Us Tax Depreciation In Sap Part 5 Mid Period And Mid Quarter Convention Serio Consulting

How To Calculate Depreciation Depreciation Guru

Automobile And Taxi Depreciation Calculation Depreciation Guru

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Macrs Depreciation Calculator Macrs Tables And How To Use

Modified Accelerated Cost Recovery System Macrs A Guide